Journey Home

A helpful guide to your first mortgage.

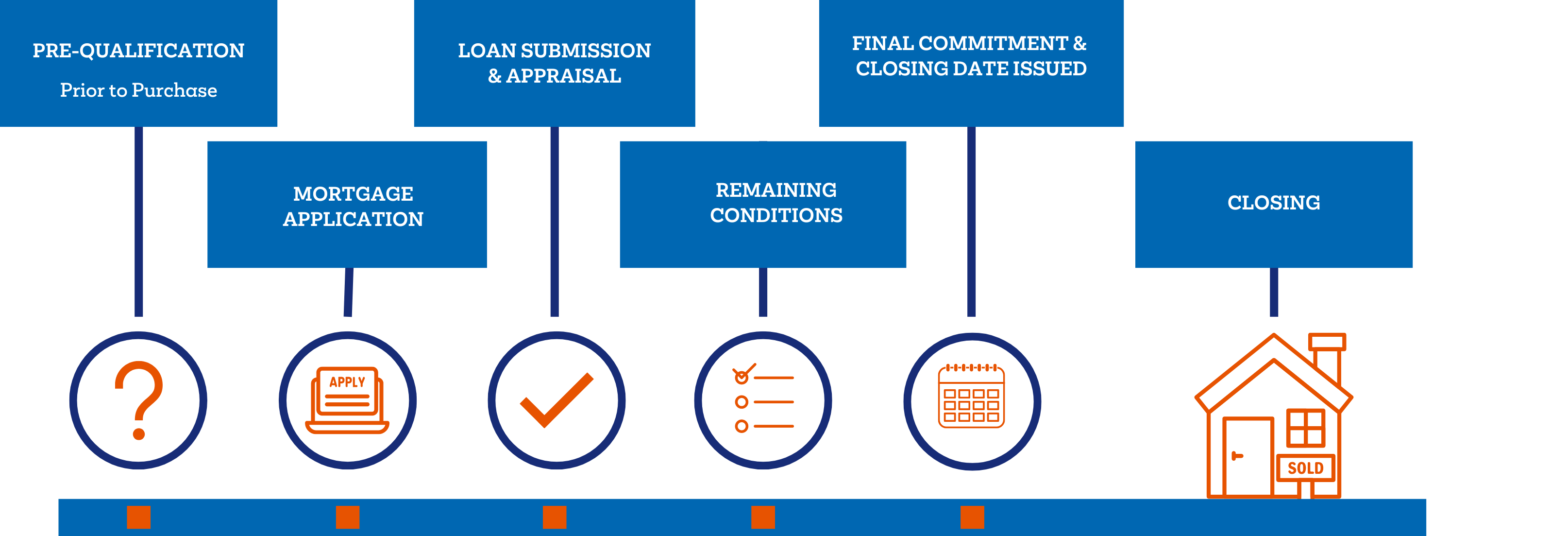

Buying your first home is a big step, so we’ve broken it down into a few smaller ones. This handy infographic has all the information you need about the process, documents you need to provide, and what you can expect along the way. After all, we’re here to make sure you feel at home — right up until you move into yours.

Prior to Purchase Pre-Qualification

Mortgage Application

Loan Submission & Appraisal

Remaining Conditions

Final Commitment & Closing Date Issued

Closing

First things first. Let’s determine how much you can borrow based on your income, credit score, and a few other factors. Taking this step also shows real estate agents that you’re the real deal; a qualified buyer. We can also talk about possible down-payment and closing cost assistance options with you.

We’ll ask you to complete a Pre-Qualification Profile and to submit documents to verify your income. Now for the exciting part. Once you’ve fallen in love with a home, made an offer, and the seller has accepted (or if you’re refinancing your current loan), your Loan Officer will review some mortgage options with you. Within three business days, they’ll prepare an application and disclosure package for you to review and sign.

Next, you’ll be asked to acknowledge receipt of your Loan Estimate and Initial Disclosure package. And once you’ve given your “Intent to Proceed,” we’ll ask you to submit additional documents to verify your income and financial situation.

Once your application, supporting documents, and appraisal fee have been received, your loan will be prepared and submitted to underwriting. We’ll have the property appraised by an independent third party who will confirm the fair market value of the home.

Now we’re cooking. Upon review of your application, verified loan documentation and appraisal by our underwriters, your Loan Officer will inform you of additional conditions for your loan to be finalized. You’ll need to supply final documents to clear all underwriting conditions.

Take a break to celebrate!

Okay, welcome back. Now you’ll be contacted by the Bank’s Closing Attorney to tie up any loose ends — like finalize your closing documents and homeowner’s insurance, and acknowledge receipt of your closing date.

Three to seven days before your closing date, you’ll receive a final Closing Disclosure. This document provides a breakdown of all costs associated with your mortgage transaction. Now you just need to consult your attorney and/or realtor to confirm that closing date.

You’re in the home stretch! Now, it’s time to pay closing costs and other expenses detailed on the Closing Disclosure, and to sign the note, mortgage and all other loan documentation related to your transaction.

After that, you’ll be the proud owner of a new home. Congratulations — your journey is just beginning.

All loans subject to credit approval.

Dedham Savings and South Shore Bank are affiliate banks under a common holding company. All Mortgage loans are provided through Dedham Savings. Dedham Savings is Member FDIC, Member DIF, Equal Housing Lender, NMLS #473990. South Shore Bank is Member FDIC, Member DIF, Equal Housing Lender, NMLS #407656

Locations

Locations